Connect

Lorem ipsum Aliquam Vestibulum Nunc dignissim Cras ornare About Us Knowledge base Story Terms Contact UsSpot Forex is a leveraged financial product geared towards...

Crypto World

Lorem ipsum Aliquam Vestibulum Nunc dignissim Cras ornare About Us Knowledge base Story Terms Contact UsSpot Forex is a leveraged financial product geared...

Equity Funds

Despite widespread vaccination and less lethal strains of Covid-19 leading to lower fatality rates, 2022 proved to be another challenging year. Supply chain disruptions, the lingering effects of fiscal stimulus, and Russia’s invasion of Ukraine caused inflation to skyrocket to its highest level in 40 years. The Federal Reserve (Fed) and other central banks took aggressive tightening measures, resulting in sharp selloffs in both fixed income and equity markets.

The mid-term elections produced a divided government, implying a slim possibility of implementing structural reforms to address long-term problems or providing fiscal support should the economy falter. Although inflation pressures are expected to ease towards the end of 2022, recession is widely predicted for 2023, adding to the already daunting economic challenges.

Based on recent data flow, it appears that solid growth and stubborn inflation scenario are more likely, which is our current base case. However, there is still a lack of certainty about the path of inflation, while growth remains resilient. This situation increases the possibility of more monetary tightening than previously expected. As a result, it has become challenging to take strong directional positions in multi-asset portfolios.

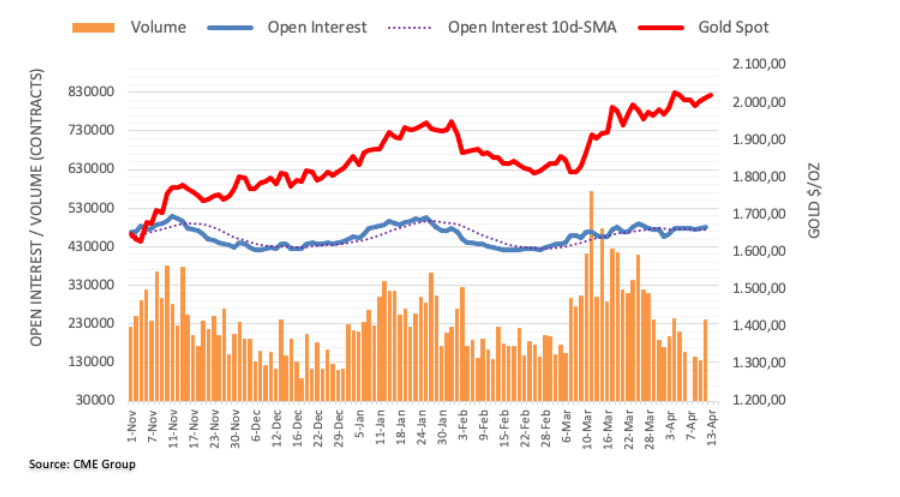

Our outlook for gold is moderately bullish, and we expect it to rise and then turn negative again at $2300. However, we have low confidence in this view, which is why our preference is to overweight duration. Currently, our portfolio positioning is close to neutral, and we are inclined towards relative value positions in forex and precious metals. We are more inclined towards gold and are avoiding exotic pairs that are susceptible to further risk policy tightening

International economy: Feeling the hangover of inflation and high interest rates—China being the exception to the rule

In 2022, the U.S. dollar experienced a surge due to uneven central bank tightening and fears around global growth. Despite a slight dip towards the end of the year, the currency had appreciated by 9% year-over-year as of November, reaching its highest level in real terms since 1985. While many central bankers and investors worldwide would welcome a decline in the U.S. dollar, such a slide may not occur until rate differentials stabilize and global economic growth surprises become less negative.

financial markets bore the brunt of the global storm, with international equities declining 15% in U.S. dollars, and the future looks uncertain for the real economy in 2023. The year was characterized by a 15% multiple contraction and a 9% drag from currency weakness, leading to negative returns. However, earnings held up thanks to resilient demand, higher prices, weaker currencies benefiting exporters, and elevated commodity prices benefiting energy and materials companies. In contrast, 2023 is expected to see the opposite trend with still-high earnings expectations likely to be revised downwards, especially in Europe, where consensus forecasts remain at 0% earnings growth amidst a likely recession. Nonetheless, some multiple expansion and currency strength are expected to offset these declines as investors gain confidence that the worst has been priced into expectations throughout the year

When analyzing portfolio positioning using Morningstar categories and portfolio analysis tools, it appears that investors are not fully implementing their views. While there has been a shift from U.S. value to growth, the average analyzed portfolio is still overweight on growth due to passive investing. Bond allocations show a preference for quality and duration, but high-yield exposure may be too high given economic headwinds. On the other hand, international markets, especially on the developed side, are underweighted relative to strategic asset allocation views, potentially reflecting geopolitical concerns.

Despite these discrepancies, today’s opportunities have not been fully embraced. The macro environment has been turbulent in recent years, depressing financial assets and causing significant dislocations within and across asset classes. Although the turbulence and uncertainty are not over, markets tend to move ahead of the business cycle. Therefore, investors should reassess their portfolio positioning at the beginning of 2023, taking into account their own goals and the opportunities that distorted valuations present for active portfolio management and security selection across broadly diversified portfolios.

To make informed decisions about portfolio positioning, investors may consider various technical indicators and analytical tools, such as moving averages, relative strength indicators, and asset correlation matrices. These tools can help investors identify trends and potential risks in various asset classes, as well as opportunities for diversification and risk management. Additionally, investors may choose to work with financial advisors or portfolio managers who have expertise in navigating complex market conditions and implementing sophisticated investment strategies.

The 2023 Global Forex Outlook: Opportunities and Challenges Amidst a Volatile Market

The forex market is an ever-changing landscape influenced by a variety of factors such as political events, economic indicators, and technological advancements. As we move into 2023, the global forex market is expected to continue to experience volatility, presenting both opportunities and challenges for traders.

One of the key factors that will likely impact forex trading in 2023 is the ongoing global economic recovery from the COVID-19 pandemic. As countries gradually reopen their economies and travel restrictions are lifted, we can expect to see increased demand for foreign currencies, especially those of countries that have successfully managed the pandemic. This increased demand could lead to greater volatility in the forex market, presenting opportunities for traders who are able to accurately predict currency movements.

Another factor that could impact forex trading in 2023 is the growing adoption of digital currencies, including Bitcoin and other cryptocurrencies. As more investors begin to embrace digital currencies as a viable alternative to traditional currencies, we can expect to see increased volatility in the forex market. This volatility may be especially pronounced in countries that are slow to adopt digital currencies, as their traditional currencies may become less attractive to investors.

Geopolitical events are also expected to continue to influence forex trading in 2023. With rising tensions between major world powers such as the US, China, and Russia, traders will need to stay abreast of geopolitical developments and be able to react quickly to any unexpected news or events.

In terms of specific currency trends, the US dollar is likely to remain a dominant force in the forex market in 2023. The US Federal Reserve’s monetary policy decisions will continue to impact the value of the dollar, as will the ongoing debate over the US government’s fiscal stimulus measures.

Overall, the global forex market is expected to remain highly volatile in 2023, presenting both risks and opportunities for traders. Those who are able to stay informed about the latest economic and geopolitical developments and adapt to changing market conditions are likely to be the most successful.

“Shining Bright: The Investment Outlook for Gold in 2023”